A guide to selecting a super top-up #insurance..????????

The complete guide on selecting term - Life insurance and health insurance

A guide to selecting a super top-up #insurance..????????

Thread..

????What if we told you that you could get an extra 90 lakh worth of health coverage with annual premiums as cheap as your Amazon prime subscription (₹ 1000)?

Well, believe it or not, that's exactly what a top-up plan offers.

The idea is simple- pay cheap premiums & walk away with massive coverage.

"Well, what's the catch?"

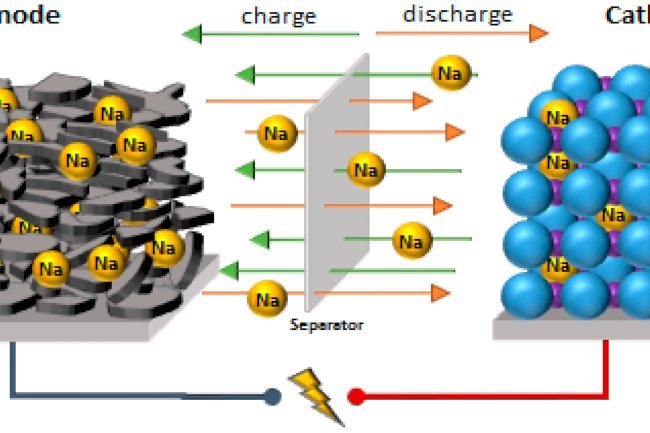

- Here's the deal. The super top-up plan is cheaper because of this little thing called a 'deductible'.

- This is the insurer telling you "We'll pay you the claim only after a certain amount fondly called the ‘deductible’ has been pitched in by you (the insured)...

- You may use an existing insurance policy to reach that threshold or pay it yourself."

- In a nutshell, a super top-up is an excellent way to boost your existing insurance coverage without spending a boatload of money.

Points to keep in mind:

1.) Combine it with an existing policy: It's in your best interest to combine a super top-up plan with an existing policy- where your existing policy fills the gap till the deductible is crossed, & your top-up can handle the rest.

2.) Buy a super top-up from the same company as your existing policy: This will ensure that the claims process is smooth & cashless in the event that you're hospitalized.

3.) Buy a super top-up on the same date as your existing policy: It’s simple logic - you want both these covers to run parallelly so as to steer clear of any confusion..

The complete guide on selecting term (life) insurance..

1) Policy duration: You buy a term plan early because when you’re young, your family won’t have a lot of savings to fall back on.

As you grow older, however, that changes..

For instance, by 60, your kids will be all grown up & your spouse will likely have a retirement fund to lean on.

And since the average life expectancy of Indians is about 70, insurers increase premiums after that age by a lot. Hence, the sweet spot lies between 60-70.

2.) Selecting a Cover: Remember, with a term plan, you're looking to replace yourself financially. There are a few key things you have to remember here like- how much are your monthly expenses? What is your annual income?

The goal is to generate enough cash flows for a reasonable amount of time, to pay for all your family expenses (including EMIs) and still leave a little extra. You can talk to us for personalized coverage advice.

3.) Choose a rider: Lastly, you can use some add-ons (or riders) to your cover to make your plan a bit more comprehensive. At Ditto we recommend going for the following riders:

- Life stage: Here, the insurer provides the flexibility to increase your cover by a certain amount during major life events like getting married & having kids.

- Waiver of Premiums: Imagine you get disabled and you lose your job. This rider will allow you to keep the policy and not worry about premiums if you get disabled.

- Critical Illness Rider: If you opt for a critical illness rider, the insurer will pay a certain amount to help you tide over the crisis of such an illness..

A simple checklist on selecting the best health insurance for you & your loved ones..

1.) Don’t split the Bill:

- Insurers might nudge you to consider a co-payment clause, in which case, you’ll be forced to foot a part of the bill each time you make a claim.

- This might not be the best option unless you have no choice, or are purchasing for elderly citizens.

2.) Restrictions on room & room rent:

- Some insurers will have a limit on room rent. And if you breach this limit, they’ll make you pay extra for every little service rendered in the room.

- Opt for a policy that doesn’t have too many restrictions on this front.

3.) Check for Disease Wise Sub-limits:

- It’s what happens when the insurer offers you a massive cover for a modest fee, only to include restrictions on coverage for each disease.

- So make sure you check these sub-limits before making a decision.

4.) Opt for pre and post-hospitalization care:

- You’ll likely have to go through a host of diagnostic tests before hospitalization. And, once discharged, there’s medication to worry about.

- So it’s best to pick a policy that covers pre & post-hospitalization care.

5.) Seek a Low Waiting Period:

- If you have pre-existing diseases (including diabetes, blood pressure, etc), you might have to wait a fixed period (typically 2-4 years) before you're covered.

- It’s best to pick a policy where you don’t have to wait a lot.

6.) Coverage for daycare treatments:

- Chemotherapy, dialysis, a quick appendectomy- all these procedures might last less than 24 hours.

- And some insurers might not cover these claims, because they don’t do “daycare treatments”. So make sure you check for daycare coverage!

7.) Ask for restoration benefit:

- What if your insurer restores your cover each time you make a claim. Brilliant right?

- If not every time, maybe at least once? It’s possible with a restoration benefit. You need only ask..