: Taxation

Case Laws on Section 68 of Income Tax, Cash Credit - Im...

*Got a notice from Income Tax on unexplained Cash Credit and don't know how to respond?* Here are some Interesting Landmark Judge...

Shall Consumers Reap the Benefits of Reduced GST Rate

Goods and Service Tax (GST) was levied in India from 1st July 2017 through 101st Amendment in the Constitution. The Four Tier GST ...

Equalisation Levy, a Step Towards Resource Mobilisation

The Digital Economy has created a huge impact on the traditional economy. In 2016 it represented 15.5% of the Global GDP. With a d...

Treatment of One time settlement (OTS) by Bank or Loan ...

Whether Loan default of Nirav Modi amounts to “Income” liable for taxation? Instances of Loan default & settlement, loan waiver, o...

TRAN-1 not claimed???Claim Now!!! On or Before 30.06.20...

Know which law has come to rescue in claiming TRAN-1 Credit for which time period has expired and which entities applied writ peti...

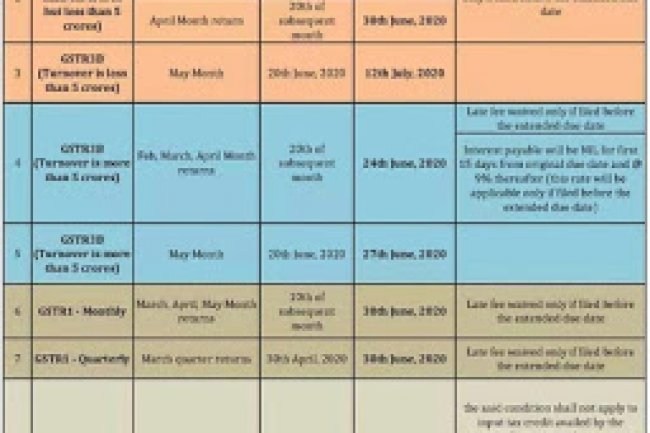

Extention of due dates announced by govt of India due t...

Extention of due dates for return filing under GST by govt of India due to covid 19