Shall Consumers Reap the Benefits of Reduced GST Rate

Goods and Service Tax (GST) was levied in India from 1st July 2017 through 101st Amendment in the Constitution. The Four Tier GST structure was introduced with a minimum rate of 5% and a maximum of 28%. The consumer of the commodity at each successive level can claim the Input Tax Credit of the GST paid. However, have you ever thought that in case of a reduction of GST rate, would the benefit of reduced tax rate pass on to the next consumer. What is the Government action plan for passing on the benefit? To know about it in detail, read the article.

|

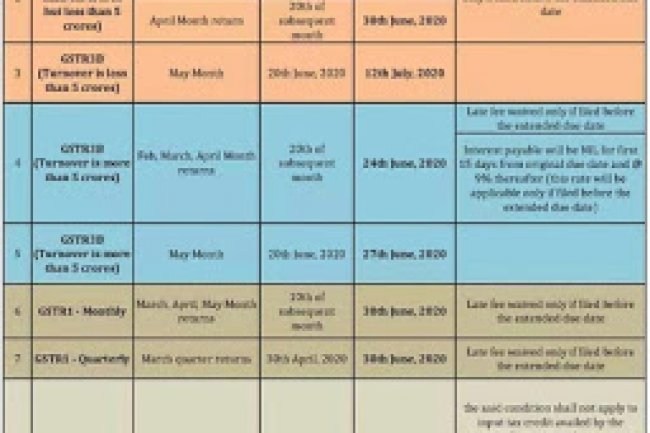

Introduction: Goods and Service Tax (GST) was introduced in India in 2017, which was one of the biggest tax reform for independent India. The primary objective behind the introduction of GST was "One Nation One Tax", a Destination based tax that is levied at every stage of value addition. Another objective of GST was reducing the cascading effect of taxes which occurs due to levying of multiple taxes. Now, as the GST is levied at every value addition stage, this increased in price of goods/services. In order to avoid this issue Input Tax Credit (ITC) was introduced. The immediate consumer will be entitled to take ITC on the tax paid by him. Every year the GST Council revises the GST rate leviable on the goods and services as per the business requirements, to ensure that the benefit of the reduced tax rate is passed to the Consumer. Anti Profiteering measures were introduced by the Government in the year 2017 for upto 30th November 2019, which has now been further extended up till 30th November 2021. What do you mean by Profiteering? When a person illegaly makes profits, it has been termed as Profiteering. In the year 2010 a report titled "Implementation of Value Added Tax in India- Lessons for Transition of GST" released by Comptroller and Auditor General of India, the report stated that despite in reduction of tax rates the manufacturers have not passed the benefit of tax reduction on to the next level consumer, this has been termed as Profiteering. As learning obtained from VAT, it was decided that GST would be brought into force along with its Anti Profiteering measures. This can be better understood with the help of an example, suppose Mr. Raj manufacturer of a refrigerator brand in India registered in Delhi, supplies the model XY12 at an MRP of Rs. 12,800.00 inclusive of 28% GST, so retailer Mr. Anand registered in Mumbai used to pay Rs. 12,800.00 and would claim ITC of Rs. 2,800.00. In its annual meeting, GST Council has revised the GST Rate to 18%, so this reduction in the rate would reduce the MRP to Rs. 11,800.00 and the retailer Mr. Anand would claim ITC of Rs. 1,800.00. If not so, then this would be considered as Profiteering. Statutory Mechanism under GST Law for Anti Profiteering: As per section 171 of the Central Goods and Service Tax Act, 2017 states that a benefit of reduction in the tax rate should be passed on to the recipient, through the reduction in the MRP of the goods/services and authority shall also examine the benefit of the reduced tax rate on Input Tax Credit availed. Section 171(3A) of the Central Goods and Service Tax Act, 2017after conducting of examination by the authority, if a person has been held liable for profiteering, he shall be held liable for a penalty equivalent to the 10% of the amount profiteered. However, he shall be exempted from the penalty, if the profiteered amount is deposited within 30 days of the Order. As per Rule 126 of the Central Goods and Service Tax Rules, 2017authority can determine the procedure for determining whether the benefit of reduced GST rates has been passed on to the buyer. What is an Anti Profiteering Mechanism? Under the GST Act, the supplier of the goods and services ought to pass the benefit of reduction in GST rates to the customer by changing the MRP and the benefit of reduced tax should also be passed in the calculation of Input Tax Credit. For the regularization of the mechanism the National Anti Profiteering Authority has been formed, there is Directorate General of Anti Profiteering and a Standing committee and a State Screening Committee in case of profiteering activity the customer has a right to file a complaint against the supplier in the prescribed format.

What is a National Anti Profiteering Committee and what’s its constitution? The National Anti Profiteering (NAA) Committee is a regulatory mechanism under the GST Act to keep a check on the profiteering activities of the suppliers. The NAA was constituted in the 22nd GST Council meeting held in Guwahati. The authority has the following members:

The motives behind the constitution of NAA are as follows:

Who is the Directorate General of Anti Profiteering and what are his powers?

Standing Committee and State Clearing Committee: The GST Council constitutes a Standing Committee having its members appointed from the Central and State Government. Standing A State Level Screening Committee is constituted by the State Government, in which one officer is appointed by the Commissioner and one officer of the Central Government is appointed by the Chief Commissioner. Every State should have one State Level Screening Committee. As per Rule 128(2) of the Central Goods and Service Tax Rules, State Level Screening Committee looks after the cases of their State for profiteering in case of a reduction of GST Rates, they first review the application received by them within 2 months and in case of profiteering as stated in Section 171 of the Central Goods and Service Tax Act, 2017 the application is forwarded to the Standing Committee. If the Standing Committee is satisfied regarding the matter for investigation the case is forwarded to Directorate General of Anti Profiteering.

WHO CAN FILE AND HOW CAN YOU FILE A COMPLAINT AGAINST PROFITEERING?

REFUND OF AMOUNT IN CASE OF PROFITEERING: As per Rule 127(iii) (b) of the Central Goods and Service Tax Rules, 2017 the person can claim a refund on the excessive amount paid by him, despite a reduction in the GST rate. A refund will be given along with 18%interest p.a. from the date of payment of excessive amount till the time amount not returned. If the claim has not been made, the excessive tax collected will be transferred to the Consumer Welfare Fund.

MY VIEWS IN FAVOUR:

MY VIEWS AGAINST:

My Suggestions:

SOURCE: |